A comprehensive digital transformation that increased mobile banking adoption by 78% and reduced operational costs by 35% within 12 months.

International Financial Institution, a leading financial institution in the UAE with over 1.2 million customers, was facing significant challenges in their digital banking operations. Despite having invested in various digital initiatives over the years, the bank was struggling with:

The bank's core banking system was over 15 years old, creating silos of information and preventing a unified customer view. Integration with modern services was complex and costly.

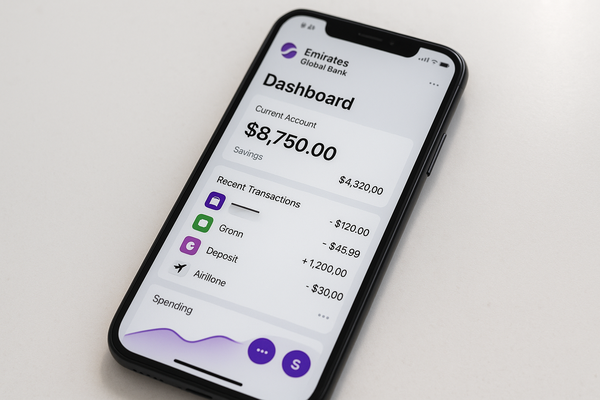

Their existing mobile app had a user satisfaction rating of just 2.3/5, with customers complaining about crashes, slow performance, and limited functionality compared to competitors.

With increasing cyber threats targeting financial institutions in the region, the bank needed to strengthen their security infrastructure while maintaining ease of use.

Manual processes were still prevalent, with over 40% of customer service requests requiring branch visits or phone calls, creating bottlenecks and increasing operational costs.

After extensive consultation with International Financial Institution's leadership team, we established the following key objectives for the digital transformation project:

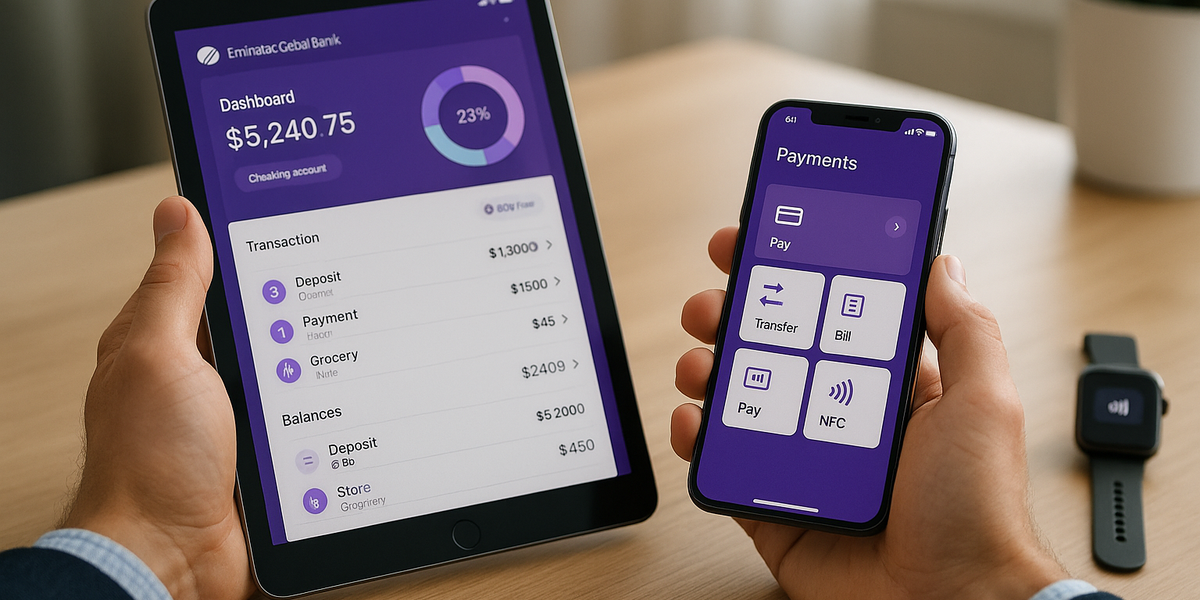

Create a state-of-the-art mobile banking platform with intuitive UX design and comprehensive functionality to increase customer satisfaction and digital adoption.

Implement multi-layered security measures including biometric authentication, real-time fraud detection, and end-to-end encryption while maintaining user convenience.

Develop a flexible middleware layer to connect legacy systems with new digital services without disrupting critical banking operations.

Implement AI-powered chatbots and automated processes to reduce manual interventions and enable 24/7 self-service for common banking tasks.

Aries Star Marketing OPC adopted a phased, customer-centric approach to International Financial Institution's digital transformation, ensuring minimal disruption to ongoing operations while delivering rapid improvements:

We conducted comprehensive stakeholder interviews, customer journey mapping, and technical system audits to identify pain points and opportunities. This included analyzing 18 months of customer feedback and support tickets to prioritize improvements.

Our team created detailed wireframes and prototypes for the new mobile experience, while simultaneously designing a flexible API layer to bridge legacy systems with new services. All designs underwent rigorous user testing with actual bank customers.

Using a microservices architecture, we developed the new platform in two-week sprints, allowing for continuous feedback and adjustments. This approach enabled us to deliver incremental value while maintaining system stability.

Rather than a risky "big bang" launch, we rolled out features gradually to select customer segments, gathering feedback and optimizing before wider release. This reduced risk and allowed for continuous improvement.

We developed a completely reimagined mobile banking experience with a focus on simplicity, performance, and functionality:

To address the challenge of legacy systems, we built a flexible middleware layer that:

We implemented intelligent automation to enhance customer service efficiency:

We implemented a comprehensive security strategy that balanced protection with usability:

The digital transformation initiative delivered significant, measurable improvements across key performance indicators:

Following the successful implementation, Aries Star Marketing OPC continues to support International Financial Institution with:

This long-term partnership ensures that International Financial Institution maintains its competitive edge in the rapidly evolving digital banking landscape.

Let's discuss how our digital solutions can help your banking or financial institution thrive in the digital age.

Schedule a Consultation