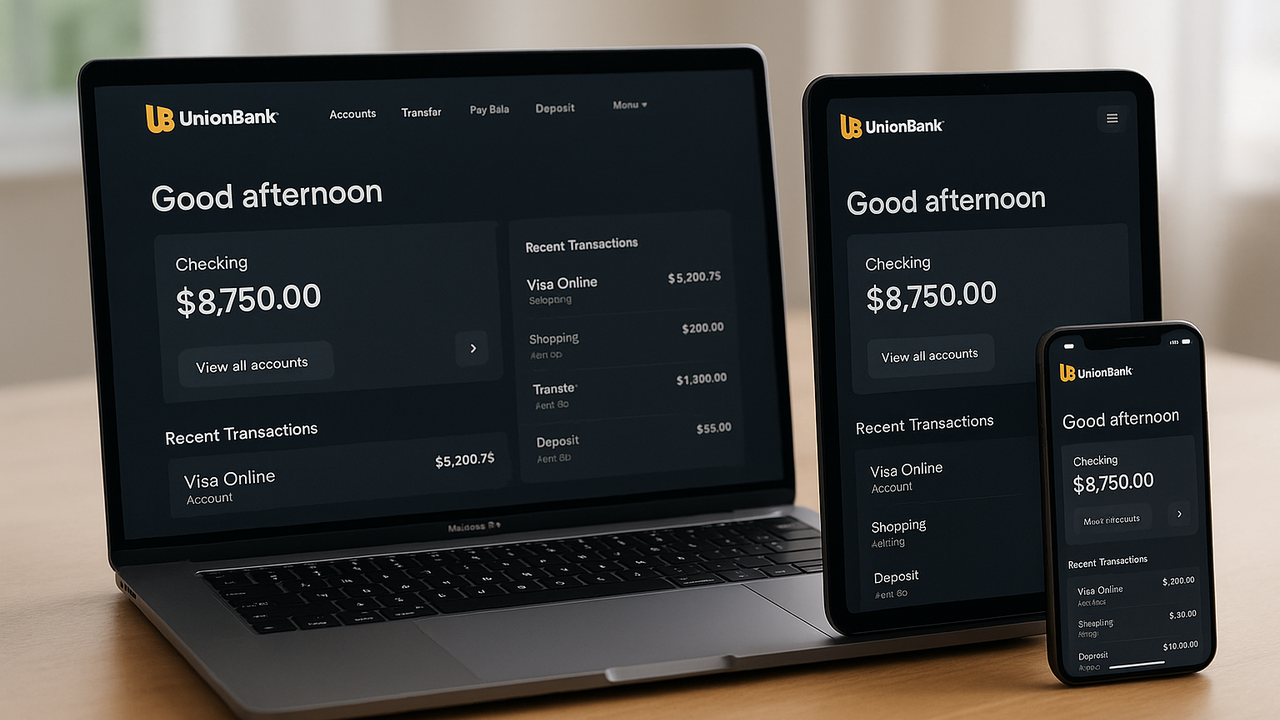

How we helped one of the Philippines' leading banks revolutionize their digital banking experience and achieve record-breaking customer engagement

A leading Philippine bank, one of the country's major financial institutions, was facing increasing competition from digital-first fintech startups and needed to accelerate their digital transformation to maintain market leadership. The bank was struggling with:

The bank's leadership recognized that a comprehensive digital transformation was necessary not just to compete but to lead in the rapidly evolving Philippine banking sector. They needed a partner with both global expertise and deep understanding of the local market.

Aries Star Marketing OPC worked closely with the bank to develop a comprehensive digital transformation strategy that addressed both technical challenges and organizational change management.

We began with an extensive discovery phase, conducting stakeholder interviews, customer journey mapping, and technical assessments to identify pain points and opportunities. This allowed us to create a roadmap that aligned with the bank's vision of becoming "a tech company with a banking license."

Our team worked with the bank's leadership to establish clear KPIs and success metrics for the transformation initiative, ensuring alignment across all departments and stakeholders.

We implemented a multi-phase approach to modernize the bank's technology infrastructure:

Recognizing that digital transformation is as much about people as technology, we implemented a comprehensive change management program:

The partnership between Aries Star Marketing OPC and the Philippine bank delivered exceptional results, positioning the bank as a digital leader in the Philippine banking sector.

Increase in mobile banking adoption among customers within 12 months

Reduction in time-to-market for new financial products and services

New customer accounts opened through digital channels

Increase in digital transaction volume year-over-year

"Aries Star Marketing OPC has been an invaluable partner in our digital transformation journey. Their team's technical expertise combined with their deep understanding of the Philippine banking landscape helped us not just modernize our systems but fundamentally transform how we serve our customers. The results have exceeded our expectations and positioned our bank as a digital leader in the industry."

We helped the bank implement one of the first blockchain-based remittance systems in the Philippines, significantly reducing transaction costs and processing times for overseas Filipino workers sending money home.

This innovative solution cut remittance fees by up to 75% and reduced transaction times from days to minutes, providing substantial value to customers and creating a competitive advantage for the bank.

We developed an AI-powered financial assistant that provides personalized financial advice, spending insights, and proactive notifications to customers through the mobile app.

The assistant uses machine learning algorithms to analyze transaction patterns and help customers make better financial decisions, improving engagement and loyalty while reducing the burden on human customer service representatives.

We designed and implemented an open banking API platform that allows third-party developers to securely build applications and services around the bank's financial infrastructure.

This platform has fostered a vibrant ecosystem of fintech partnerships and innovations, creating new revenue streams for the bank and expanding their service offerings without significant internal development costs.

Let's discuss how our digital transformation expertise can help your organization achieve similar results.

Schedule a Consultation