How Aries Star Marketing OPC helped one of the UAE's largest banking groups modernize their digital infrastructure and enhance customer experience across multiple channels.

This major Middle Eastern bank is one of the largest banking groups in the Middle East, with a significant presence across the UAE and international operations in Egypt, Saudi Arabia, India, Singapore, the United Kingdom, and representative offices in China and Indonesia. With over 900 branches and 4,000 ATMs/SDMs, this bank serves millions of customers with a wide range of banking and financial services.

As a leader in the banking sector, this institution has always been at the forefront of innovation, but they faced challenges in keeping pace with rapidly evolving customer expectations and the digital transformation sweeping through the financial industry.

The major Middle Eastern bank approached Aries Star Marketing OPC with several key challenges that were impacting their ability to deliver exceptional digital banking experiences:

Legacy Systems Integration: The bank operated on multiple legacy systems that were difficult to integrate, creating data silos and inefficiencies in operations.

Customer Experience Fragmentation: Different banking channels (mobile, web, branch, ATM) offered inconsistent user experiences, leading to customer confusion and dissatisfaction.

Digital Onboarding Friction: The account opening and customer onboarding processes were largely paper-based, requiring branch visits and extensive documentation.

Limited Personalization: The bank had limited ability to leverage customer data for personalized offerings and recommendations.

Security Concerns: As digital banking adoption increased, so did concerns about cybersecurity threats and fraud prevention.

Regulatory Compliance: The need to maintain strict compliance with evolving financial regulations while innovating presented a significant challenge.

Aries Star Marketing OPC developed a comprehensive digital transformation strategy for the major Middle Eastern bank, focusing on creating seamless, secure, and personalized banking experiences across all channels.

API-First Architecture: We implemented an API-first approach to connect legacy systems with modern applications, creating a flexible and scalable infrastructure that could evolve with changing needs.

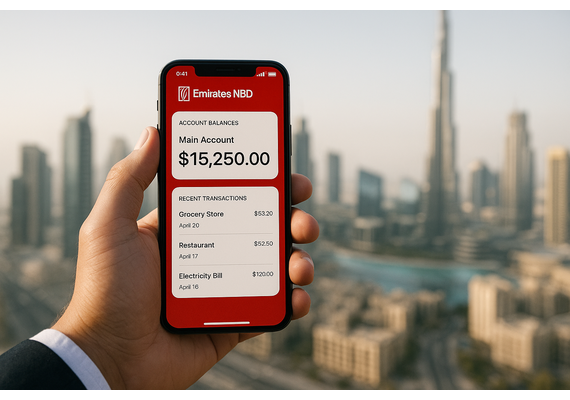

Omnichannel Experience Platform: We designed and developed a unified platform that ensured consistent customer experiences across mobile apps, web banking, ATMs, and in-branch services.

Digital Onboarding System: We created a paperless onboarding solution with advanced KYC (Know Your Customer) features, including biometric verification, OCR for document scanning, and electronic signature capabilities.

"The digital onboarding solution developed by Aries Star has transformed our customer acquisition process. What used to take days now happens in minutes, dramatically improving customer satisfaction while reducing operational costs."

AI-Powered Personalization Engine: We implemented a machine learning system that analyzes customer data to deliver personalized product recommendations, spending insights, and financial advice.

Enhanced Security Framework: We deployed a multi-layered security system with advanced fraud detection, biometric authentication, and real-time transaction monitoring.

Regulatory Compliance Automation: We developed automated compliance monitoring and reporting tools to ensure adherence to regulatory requirements while streamlining internal processes.

Our team worked closely with the major Middle Eastern bank through a phased implementation approach that minimized disruption while delivering continuous improvements:

Phase 1: Discovery & Strategy (2 months)

We conducted comprehensive assessments of existing systems, customer journeys, and pain points. This phase included stakeholder interviews, customer research, and competitive analysis to develop a detailed transformation roadmap.

Phase 2: API Foundation & Integration (4 months)

We built the core API infrastructure to connect legacy systems and enable data flow across the organization. This created the foundation for all subsequent digital initiatives.

Phase 3: Mobile & Web Banking Redesign (5 months)

We completely redesigned the mobile and online banking platforms with a focus on intuitive user experience, performance, and security. The new applications were developed using modern frameworks and followed a microservices architecture.

Phase 4: Digital Onboarding & KYC (3 months)

We implemented the paperless onboarding system, allowing customers to open accounts and apply for products entirely through digital channels with robust identity verification.

Phase 5: AI & Analytics Implementation (4 months)

We deployed the personalization engine and advanced analytics capabilities, enabling data-driven decision-making and personalized customer experiences.

The digital transformation initiative delivered significant measurable results for the major Middle Eastern bank:

Increase in digital onboarding completion rates

Reduction in customer onboarding time

Increase in mobile banking active users

Growth in digital product sales

Reduction in call center volume

Customer satisfaction with new digital channels

Business Impact:

"Our partnership with Aries Star Marketing has been transformative. Their expertise in digital banking solutions and deep understanding of the Middle Eastern market helped us achieve our vision of becoming the region's most innovative and customer-focused bank."

Through this project, we identified several critical success factors for digital transformation in banking:

Executive Sponsorship is Crucial: Having strong support from the bank's leadership team was essential for driving change across the organization.

Balance Innovation with Stability: We implemented a dual-speed IT architecture that allowed for rapid innovation while maintaining the stability of core banking systems.

Customer-Centric Design: Involving customers throughout the design process ensured that the solutions addressed real needs and pain points.

Cultural Transformation: Technical changes needed to be accompanied by organizational and cultural shifts to embrace digital ways of working.

Regulatory Collaboration: Early engagement with regulatory authorities helped ensure compliance while enabling innovation.

Let's discuss how our global technology solutions can help you achieve your business goals.

Get A Free Consultation